An EB-5 visa is an option granted to foreigners who can invest in a business and create ten jobs for American citizens. If the investor’s EB-5 visa petition is approved, they will be able to move to the US and work. However, you have to pay a certain amount of money to get this visa before you are able to actually put it to use. This article will discuss how you can go about getting a loan for an EB-5 visa.

EB-5 Loan Requirements

Like any kind of visa, the EB-5 visa program has requirements that investors must meet, such as:

- EB-5 investor’s asset value: Your asset value has to be equal to or more than the loan amount, and the market interest rate has to apply even for an individual loan. The mortgage must also be documented within the government’s property records to apply.

- Securing with personal property: The requirement states that the investor can only use their personal property when they are securing the loan. Examples of assets or property you can use include jewelry, real estate, stocks, and precious metals.

- Primary borrower: The EB-5 visa loan has to be under the investor’s name, and they must be solely liable for making payments on the loan.

- Source of funds: An investor must prove how their collateral for an EB-5 loan was purchased. It’s also required to verify that the funds used for the purchase were lawfully earned.

- Immigrant investor net worth: The immigrant investor who is the primary borrower must have a net worth that exceeds $900,000. They must also have at least $400,000 in liquid assets before the loan application.

Since 2022, EB-5 loans have become more popular since the RIA raised the minimum investment amount. This amount went up from $500,000 to $800,000, resulting in more people wanting to borrow money so they could finance their EB-5 applications.

Pros and Cons of EB-5 Loans

Before you decide that you want to go on the path of getting an EB-5 loan, you need to understand the benefits and the downsides. One of the benefits of an EB-5 loan is that there is additional safety for investors.

With a security loan, there is some kind of collateral that investors can use if the borrower fails to repay the loan. The downside to this is that the collateral has to fully secure the loan. Otherwise, the investor may not get their total investment back.

Another benefit to an EB-5 loan is that there is a more predictable repayment timeline. Investors can have more peace of mind knowing that they will be repaid due to factors such as a limited number of extensions and a set maturity date.

A downside to an EB-5 loan is that the offerings often provide a lower annual return rate for investors. For some, this may not be important, but it is worth considering before going this route.

Secured Vs. Unsecured EB-5 Loan

An area that can become confusing is understanding secured versus unsecured EB-5 loans. All loans are either secured by collateral or are unsecured, which means they do not have any collateral set up.

Most investors choose secured loans since they are easier to find. Unsecured loans are much harder to find and are more likely to have a higher interest rate or other additional charges that a secured loan wouldn’t have.

Secured EB-5 loans are considered to be a better option since there is something to fall back on if the borrower does not repay the loan.

Land-Based Loan Transactions

Another option investors have is using a bank loan that is secured by land, which is a land-based loan transaction. To do this, you need to provide copies of the most relevant loan documents, including the full purchase documentation, as well as how the funds were earned. The loan also has to comply with the local laws where the land is located.

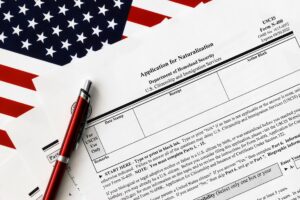

Loan Documentation For Investor Visa Loans

The process of getting an EB-5 loan can become quite complex depending on the different factors involved. If your loan is not secured, or you do your application incorrectly, this can result in the United States Citizenship and Immigration Services rejecting your application. Because of this, it is a good idea to hire an immigration attorney who can guide you through this process to ensure everything goes smoothly.

The US government, the US State Department, and USCIS will need to see certain documents when you take out a loan to fund an E2 or EB-5 visa. This includes documentation such as:

- The loan agreement

- The security agreement, which secures the loan with the collateral

- A promissory note

Negotiating EB-5 Loan Financing

When you are financing an EB-5 visa, it is advised to hire an immigration attorney to review the documentation. They will be able to help you find details in the loan documents that impact the financing agreement and how you will go about repaying it. Here are some examples of crucial details to look out for in the loan documents:

- A purpose clause that includes an EB-5 visa as a permissible use of funds. It can also state that it is used for any lawful purpose.

- Details stating if there is an early repayment penalty.

- The amount, the duration, and the procedure for disbursement of the loan.

- Any fees and costs for the loan.

- Details regarding how interest will be paid for the loan. This can include monthly, quarterly, or annual terms that detail the principal and accrued interest.

Never sign any kind of loan documents before you have had your attorney go over them, as this can lead to serious issues later on with your funding and application.

Contact an Immigration Attorney Today

Are you ready to get started on the process of securing an EB-5 loan? Contact us today at US Immigration Law Counsel by filling out our online form or calling us at (800)-666-4996. We deal with the government, so you don’t have to, and we ensure your visa process goes smoothly and successfully.